Legal teams love to calculate ROI based on "efficiency." The formula is always the same: (Hours Saved) x (Hourly Rate) = ROI.

This math is logical, but it fails in the boardroom. Why? Because unless you are actually reducing headcount (which you rarely are), those "saved dollars" never hit the P&L statement. They are Soft Savings. And CFOs don't fund Soft Savings.

The "Soft ROI" Trap

When you tell a CFO "We saved $500k in time," they hear "We made our lives easier." That's nice, but it's not a business case.

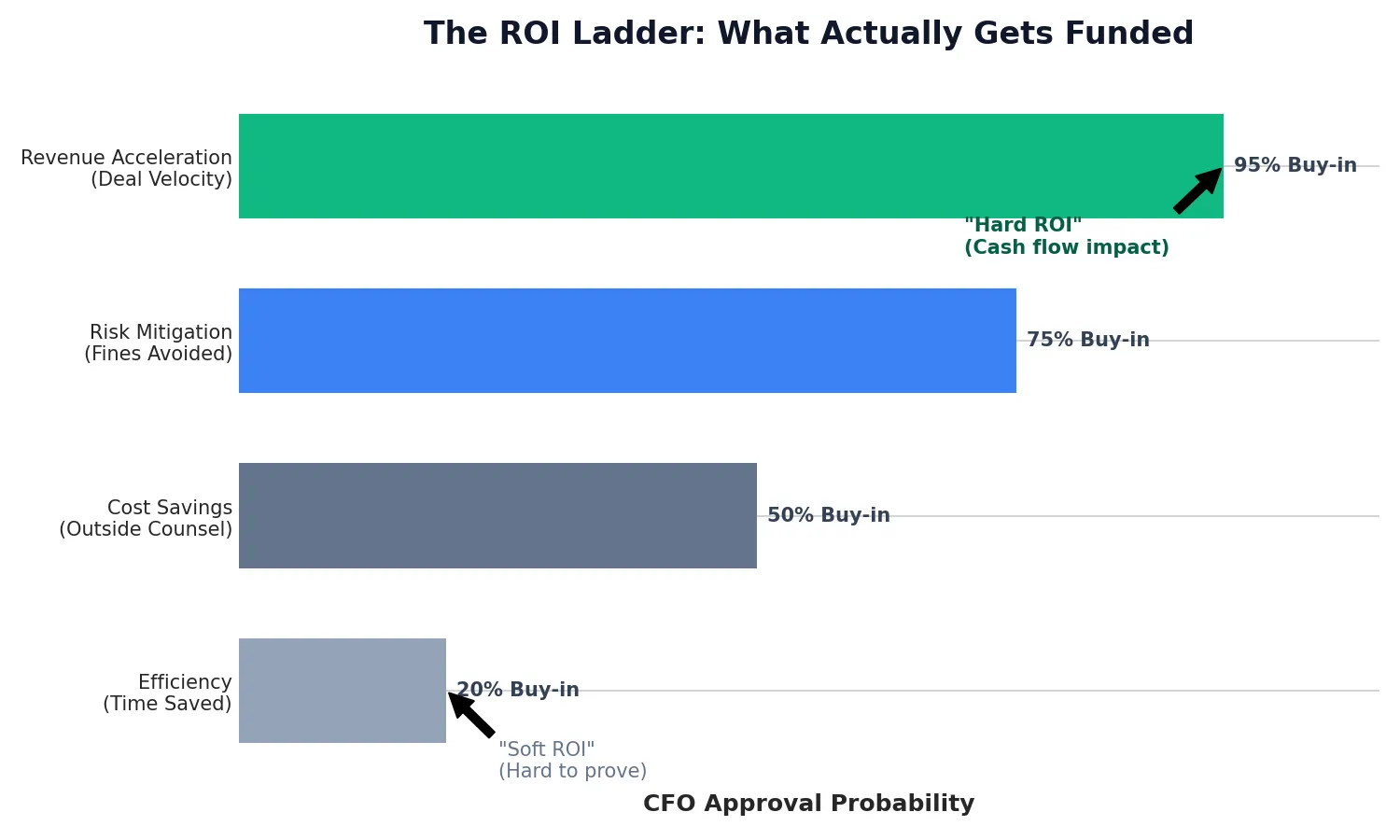

To get budget approval, you need to move up the value ladder. You need to show how CLM impacts Cash Flow.

The ROI Ladder

Why "Revenue Acceleration" gets funded while "Efficiency" gets ignored.

The "Hard ROI" Formula: Revenue Acceleration

Here is the math that actually works. It's called Deal Velocity.

If your average sales cycle is 90 days, and legal review takes 10 of those days. If you cut legal review to 5 days, you shorten the sales cycle to 85 days.

The Calculation:

(Annual Revenue) / (Sales Cycle Days) * (Days Saved) = Cash Flow Acceleration

For a $100M company, shortening the cycle by 5 days brings $5.5M of revenue forward into the current year. That is real money. That gets funded.

The Consultant's Advice

Stop talking about "Legal Efficiency." Start talking about "Sales Velocity."

Partner with your VP of Sales. Ask them: "If I could get contracts signed 3 days faster, what would that do to your quarterly targets?" Use their answer to build your business case.